[ad_1]

The on-chain analytics agency Santiment has defined how Tether (USD) and USD Coin (USDC) change inflows preceded the latest Bitcoin rally.

Bitcoin Rally Could Restart If Stablecoins See Additional Trade Deposits

In a brand new put up on X, Santiment mentioned the development within the provide of exchanges of varied belongings within the cryptocurrency sector. The “provide on exchanges” is an indicator that retains monitor of the share of the full circulating provide of the given coin at the moment sitting within the wallets of all centralized exchanges.

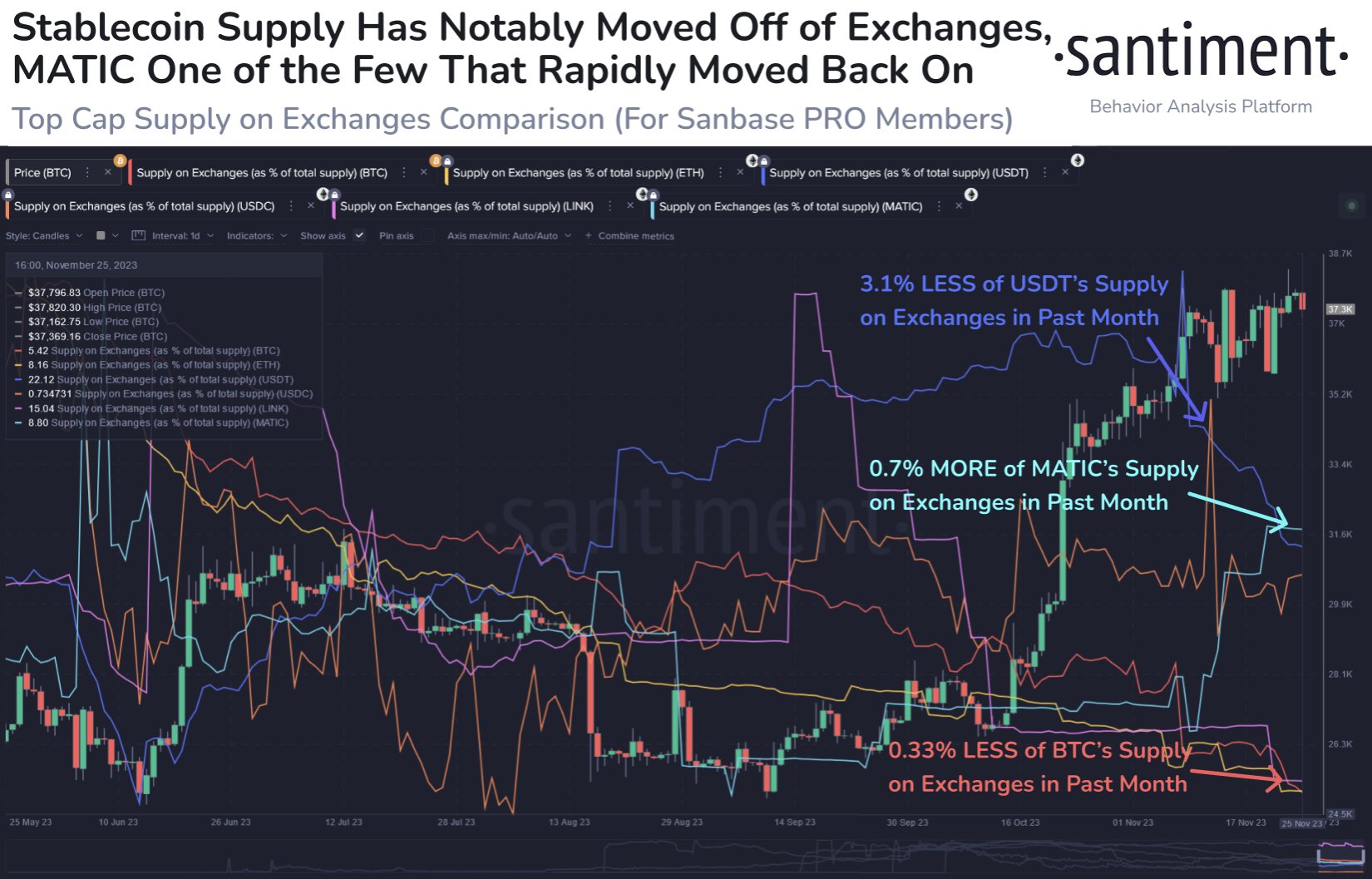

The under chart reveals the development on this indicator for Bitcoin (BTC), Ethereum (ETH), Chainlink (LINK), Polygon (MATIC), Tether (USDT), and USD Coin (USDC) over the previous few months.

The info for the change provide of the completely different cash | Supply: Santiment on X

Relying on what kind of asset it’s, the importance of the availability on exchanges can differ. Within the case of unstable belongings like Bitcoin, the availability being saved on these platforms could also be thought-about the obtainable promoting provide of the asset, as one of many essential causes buyers could deposit their cash to the exchanges is for promoting.

Thus, when this indicator tendencies up for these cryptocurrencies, it’s a possible signal that promoting strain within the sector goes up. The graph reveals that Polygon has seen 0.7% of its provide transfer to exchanges up to now month, which might be a bearish signal for its value.

Then again, Bitcoin has noticed withdrawals equal to 0.33% of its provide throughout the identical interval. Such a decline within the indicator can counsel that buyers could take part in accumulation, as they’re taking their cash off in direction of self-custodial wallets.

As for the stablecoins, a rise within the provide on exchanges additionally means that buyers want to swap these tokens. This promoting of stables, although, truly gives a shopping for increase to the unstable aspect of the market, because the buyers could use these belongings to shift into Bitcoin and others.

Because the chart reveals, each Tether and USD Coin noticed the change provide rise between August and October. Extra particularly, USDT and USDC noticed 3.54% and 0.72% of their provides shifting into these platforms, respectively. “These transfers had been the predecessor to the crypto-wide rally from late October to mid-November,” explains Santiment.

Up to now month, nevertheless, 3.1% of the Tether provide has left these platforms, whereas the USD Coin has noticed the metric transfer sideways. This may counsel that purchasing strain has stopped rising, and the other could happen.

“After a cooldown, USDT & USDC returning to exchanges might be essential to seeing market caps persevering with to extend for a giant ultimate 5 weeks of 2023,” notes the analytics agency.

BTC Worth

Bitcoin has registered some drawdown at the moment because the asset’s value has now slipped beneath the $36,800 mark.

Appears to be like just like the asset has been happening not too long ago | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Santiment.internet

[ad_2]