Identical to the Grinch, fraudsters and scammers like to benefit from unsuspecting folks. And sadly, the vacations give them loads of alternative to take action. With the rise of vacation scams, it’s vital to remain vigilant and shield your self from any suspicious exercise.

Through the season of giving and goodwill, don’t be stunned should you obtain extra suspicious calls, texts and emails than traditional. You may even really feel extra compelled to donate to a vacation fraudster’s faux charity or declare a “free” present earlier than a too-good-to-be-true supply expires.

However suppose twice earlier than you click on, obtain or reply! Be sure you know how one can spot these widespread vacation scams, so you possibly can keep away from giving freely your vacation pleasure to a Grinch.

7 vacation scams and how one can keep away from them

Earlier than making any purchases or responding to unknown numbers, study to identify these widespread vacation scams and shield your self.

1. On-line purchasing scams

On-line purchasing scams are the most typical crime reported to over 65 client safety businesses worldwide. In keeping with the Federal Commerce Fee (FTC), they’re additionally essentially the most widespread rip-off on social media. However you could possibly be at better danger for this rip-off through the holidays, since its peak on-line purchasing season.

On-line purchasing scams begin whenever you go to a faux web site that will even appear to be your favourite retail web site. Then, victims are tricked into offering fee info and could also be compromised additional by logging into the positioning by way of social media or downloading an app with malware.

Tip: Solely store on safe web sites which have “https” and a padlock image of their URL.

2. Charity scams

Charity scams benefit from folks’s generosity across the holidays. These scams normally contain calls or emails the place somebody asks you to donate to a faux charity, typically by sending cryptocurrency, a present card or cash by wire.

Even when it’s a trigger you help, resist the stress to donate this manner. As a substitute, analysis the charity so you possibly can resolve if you wish to give straight.

Tip: Confirm charities by yourself, together with identify, cellphone quantity and deal with, earlier than donating to them straight.

3. Reward card scams

Reward playing cards are a favourite fee technique of scammers, since it may be inconceivable to trace the recipient.

In keeping with the FTC, “Solely scammers will inform you to purchase a present card, like a Google Play or Apple Card, and provides them the numbers off the again of the cardboard.”

One other purple flag for present card and different vacation scams is being pressured to finish a fee instantly to keep away from a extreme penalty or declare a prize. This tactic is supposed to elicit a fast response and cease you from taking time to confirm the small print.

Tip: Keep away from transactions the place you’re pressured to pay with a present card.

4. Journey scams

Journey scams can take a number of varieties. Any such rip-off might begin with somebody calling and providing you a deep low cost on a vacation trip bundle or with a social media advert for a free or low-cost trip. The supply might be for something from a non-public flight to a timeshare, or assist with getting ready your journey paperwork.

However to assert the “deal,” you’ll be requested to pay up-front charges or taxes. After paying, you’ll uncover that you simply haven’t really gained or bought something.

Tip: If a reward is really free, you gained’t must pay to assert it.

5. Imposter scams

Imposter scams are the most typical kind of rip-off reported to the FTC in 2023.

With imposter scams, the fraudster pretends to symbolize a company or belief. They typically pose as workers of the Social Safety Administration or as tech help from an company you do enterprise with. These scammers may even spoof company cellphone numbers with caller ID.

One other imposter rip-off includes somebody posing as your relative and claiming they want cash urgently. As tempted as you might be to assist, it is best to at all times verify the data by contacting the one you love straight.

Tip: Don’t verify your private info or ship cash to somebody who makes unsolicited communication.

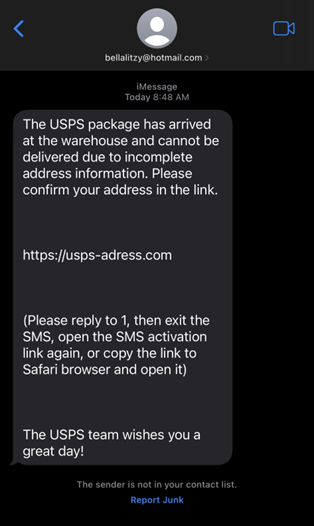

6. Supply scams

The vacations are peak season for sending and receiving packages. Sadly, that makes targets extra prone to supply scams.

These smishing scams typically begin with a textual content message that claims there’s an issue along with your supply, resembling an incorrect transport deal with. The message then urges you to click on a hyperlink to repair the problem.

However in the case of USPS monitoring, hold the next in thoughts:

- The USPS doesn’t ship unsolicited monitoring texts

- Texts from the USPS at all times embrace the monitoring quantity

- USPS textual content messages don’t embrace hyperlinks

Tip: Go to the supply to search for the monitoring info by yourself.

7. Mail theft

In the event you’re ready for a vacation bundle to reach, you won’t be the one one. Mail theft is among the many hottest vacation scams, and it merely includes stealing packages from somebody’s porch or doorstep.

Porch cameras and supply monitoring provide help to scale back your likelihood of being focused, however with out these aids, you might not understand a bundle is lacking till the thief is miles away.

Tip: Request supply updates and take note of monitoring info.

What to do should you suspect you’ve been the sufferer of a rip-off

In the event you suspect you’ve been the goal of a rip-off, it’s vital to reply shortly however fastidiously. Right here’s what you are able to do:

1. Pause first

Most scams require you to take motion to work. For instance, you’ll want to obtain an app with malware, click on on a faux advert, or share your deal with over the cellphone.

In the event you suspect you’re in the midst of an lively rip-off try, take a pause. As a substitute of clicking the hyperlink or asking questions to research additional, lower off the communication, whether or not which means closing an e mail, textual content or abruptly ending a name.

2. Go to the supply

Did you share your private info on a probably faux web site or with somebody who was presumably an imposter? In that case, go on to the supply to verify.

For instance, should you responded to a textual content message informing you of a suspicious bank card transaction, name your financial institution to see if the message was professional.

3. Report the incident

When you verify that you simply skilled a rip-off, you’ll must take steps to safeguard the data that was uncovered.

This may entail working along with your creditor to reverse a cost that resulted from bank card fraud and freezing or closing the account, contacting a credit score bureau to place a credit score freeze in place and submitting a police report.

3 Safeguard

Final, you’ll must take extra steps to forestall the scammer from doing additional injury. Listed here are just a few methods you possibly can hold your info safe shifting ahead:

- Replace your passwords and ensure every one is complicated and distinctive.

- Arrange multi-factor authentication to forestall others from logging into your accounts.

- Delete bank card info saved in your on-line profiles.

- Evaluate your monetary accounts for unauthorized transactions.

- Replace your privateness settings on social media.

- Control your credit score scores and reviews to catch uncommon exercise, like new credit score purposes.

If the rip-off resulted in id theft, you can too go to IdentityTheft.gov for a customized restoration plan.

All the time suppose earlier than responding

Scammers typically attempt to create a way of urgency. Why? As a result of they know that if in case you have time to suppose issues over, you’ll probably discover the purple flags.

So subsequent time you obtain an unsolicited message, pause earlier than responding. It’s possible you’ll even need to analysis and see if the sender is professional. By working towards this straightforward precaution, you turn out to be your personal greatest instrument for rip-off prevention. Plus, you’ll enhance your possibilities of having a peaceable vacation.

Written by Sarah Brady | Edited by Rose Wheeler

Sarah Brady is a monetary author and speaker who’s written for Forbes Advisor, Investopedia, Experian and extra. She can also be a former Housing Counselor (HUD) and Licensed Credit score Counselor (NFCC).