[ad_1]

Markus Thielen of 10x Analysis unveiled a big shift in his crypto technique in response to mounting monetary pressures and market instability, as detailed in an investor be aware launched earlier right this moment. Thielen, an influential determine within the evaluation sector, cited a regarding outlook on danger belongings, which encompasses each expertise shares and cryptocurrencies, primarily pushed by unanticipated and ongoing inflation charges.

In response to projections from Financial institution of America, US CPI headline inflation is anticipated to achieve 4.8% by the November 2024 election. Over the previous three months, month-over-month CPI inflation has averaged 0.4%. An acceleration at this velocity would imply the speed is greater than twice the Federal Reserve’s inflation goal of two% by November.

Why 10x Analysis Bought (Virtually) All Crypto And Danger Property

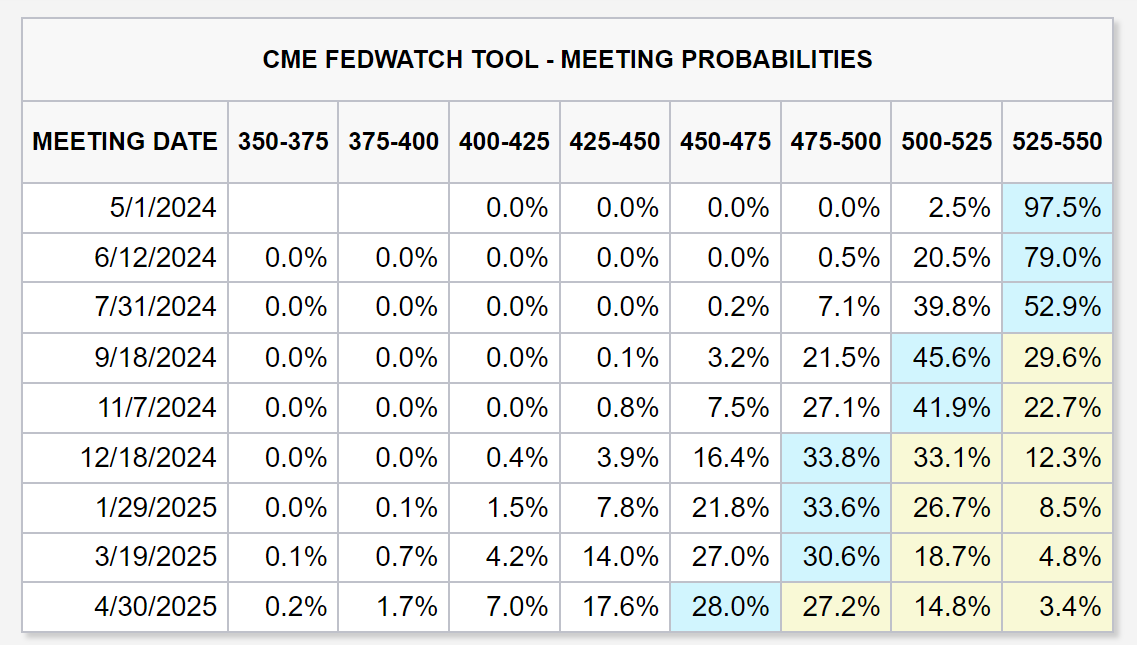

In gentle of this, 10x Analysis’s resolution to divest from dangerous belongings was catalyzed by an antagonistic shift in financial indicators. Notably, the US bond market is at present projecting fewer than three Federal Reserve charge cuts this 12 months, a big adjustment from earlier extra optimistic forecasts. In response to the CME FedWatch device, the vast majority of market contributors now suppose {that a} charge reduce by the Fed won’t come earlier than the mid-September FOMC assembly.

Moreover, the 10-year Treasury Yields have reached a peak of 4.61% this month, marking the very best charge since November 2023, additional complicating the funding panorama for danger belongings together with expertise shares and cryptocurrencies.

“Our rising concern is that danger belongings are teetering on the sting of a big value correction,” Thielen said within the be aware. “We bought all our tech shares final night time because the Nasdaq is buying and selling very poorly and reacting to the upper bond yield. We solely maintain just a few high-conviction crypto cash. General, we’re bearish on danger belongings.”

The bearish stance is additional supported by the disappointing efficiency of US-listed spot Bitcoin ETFs. Regardless of the SEC’s approval of practically a dozen such ETFs in January, which initially spurred a surge in Bitcoin costs, the inflow of capital has markedly slowed. This month, the five-day common internet inflows into these ETFs plummeted to zero, a stark distinction to the practically $12 billion that flowed into these funding autos earlier within the 12 months.

Thielen’s feedback additionally touched on the broader implications of the upcoming Bitcoin community’s quadrennial halving, scheduled for April 20. This occasion will cut back the reward for mining a block of Bitcoin by 50%, from 6.25 BTC to three.125 BTC. Whereas such halvings have traditionally spurred bullish sentiment and value will increase resulting from a perceived shortage of Bitcoin, Thielen means that the present market circumstances may dampen any potential rallies.

“It’s important to know that buying and selling is a steady recreation with high-conviction alternatives. The bottom line is to maintain analyzing the markets and uncovering these alternatives when the percentages are in your favor. There are occasions once we advocate for a complete risk-on strategy and when the precedence is safeguarding your capital, enabling you to grab alternatives at decrease ranges,” Thielen said.

In a notable trade with Matthew Graham of Ryze Labs, Thielen defended his agency’s buying and selling technique amid criticism for what was described as erratic decision-making. Graham pointed to current fluctuations in 10x Analysis’s stance on Bitcoin, citing a analysis be aware from early April that predicted a possible rally to $80,000, adopted by a extra cautious view and the current sell-off.

Thielen responded, “Truly, no. Now we have been cautious since March 8, and when the triangle breakout failed, we labored with the $68,300 cease loss. That is merely risk-reward buying and selling.” This protection highlights the risky nature of crypto buying and selling and the need for agile methods in response to quickly altering market circumstances.

Thielen concluded, promising a powerful re-entry into the market below extra favorable circumstances: “Will purchase again with each arms at 52,000 – promise.”

At press time, BTC traded at $63,045.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding choices. Use info offered on this web site solely at your personal danger.

[ad_2]