[ad_1]

Whereas Bitcoin costs hover round 15% under their all-time highs, with some skeptics predicting extra losses, one analyst on X expects the coin to bounce strongly, even breaking above all-time highs.

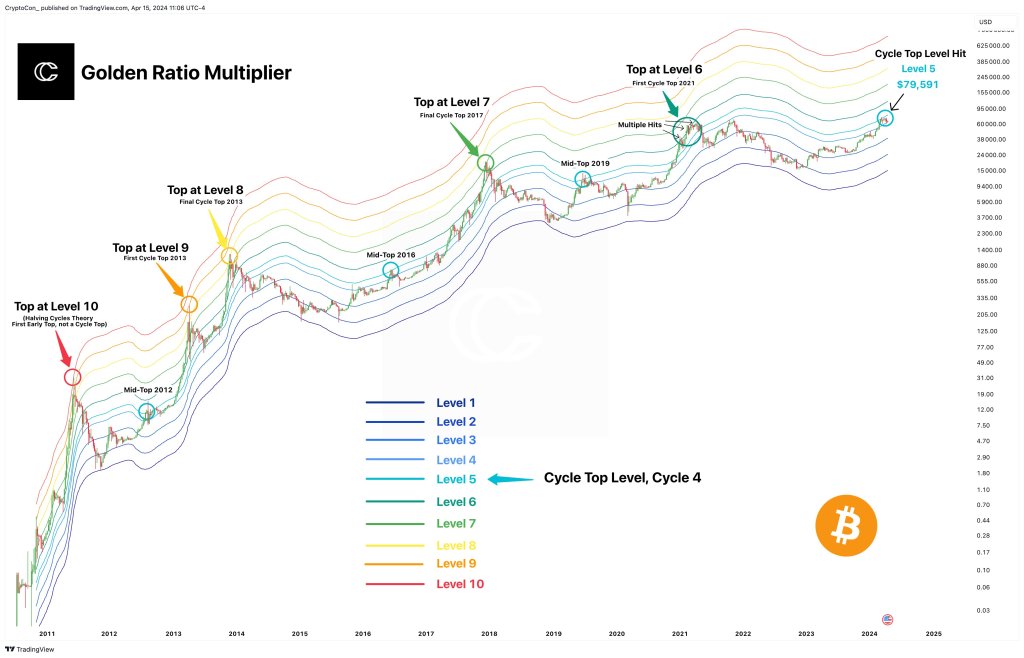

Taking to X, the dealer argues that Bitcoin has but to breach the Golden Ratio Multiplier’s Cycle Prime, at the moment sitting at $79,591. Supposedly, the analyst continues, this goal value will increase the longer it stays unchallenged.

Bitcoin Merchants Want To Be Affected person

Up to now, BTC is trending decrease and is technically inside a bear breakout formation following sharp losses on April 13. Because the coin struggles for beneficial properties and is boxed contained in the bear bar, the chances of additional upswings like these registered in Q1 2024 stay muted.

Nevertheless, at the same time as BTC bulls are muted, the analyst emphasizes the costs are “respecting knowledge factors” regardless of costs dumping decrease and taking longer to interrupt larger.

Most merchants anticipate costs to rise larger following March 2024’s spectacular surge. Nevertheless, the analyst believes merchants must have endurance.

Taking a look at how BTCUSDT costs are unfolding, it’s clear that momentum is fading, and participation is low. CoinMarketCap knowledge reveals that buying and selling quantity on the final day is flat, at $46 billion.

General, buying and selling quantity–a measure of engagement and dealer curiosity– has dropped since mid-March, when the coin soared to all-time highs of roughly $74,000.

Whales Are Conserving Off From The Market

Parallel knowledge from IntoTheBlock reveals that addresses holding no less than 0.1% have additionally been slowing down of their accumulation, making the drop much more extreme.

In accordance with a CoinDesk report, when BTC fell on March 19, costs bounced strongly on March 20 following aggressive shopping for strain whales. IntoTheBlock knowledge confirmed they purchased 80,000 BTC, forcing costs again to over $71,000.

Technically, by monitoring whale actions, merchants and buyers can gauge total market sentiment and their confidence for beneficial properties. This, in flip, may impression the sustainability of developments.

Their heavy involvement may precede sharp value beneficial properties, lifting the broader crypto markets. The truth that whales look like warding off may counsel that they anticipate costs to drop much more.

Furthermore, different elements, such because the tempo of inflows into spot Bitcoin exchange-traded funds (ETFs), level to a bleak future. CryptoQuant knowledge reveals that inflows have been stagnant previously buying and selling week. On the similar time, IBIT, the spot BTC ETF provided by BlackRock, has been the one product out of the eight registering inflows.

Characteristic picture from DALLE, chart from TradingView

Disclaimer: The article is offered for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use info offered on this web site completely at your personal danger.

[ad_2]