Particular because of Robert Sams for the event of Seignorage Shares and insights relating to the way to accurately worth unstable cash in multi-currency techniques

Be aware: we’re not planning on including worth stabilization to ether; our philosophy has at all times been to maintain ether easy to reduce black-swan dangers. Outcomes of this analysis will doubtless go into both subcurrencies or unbiased blockchains

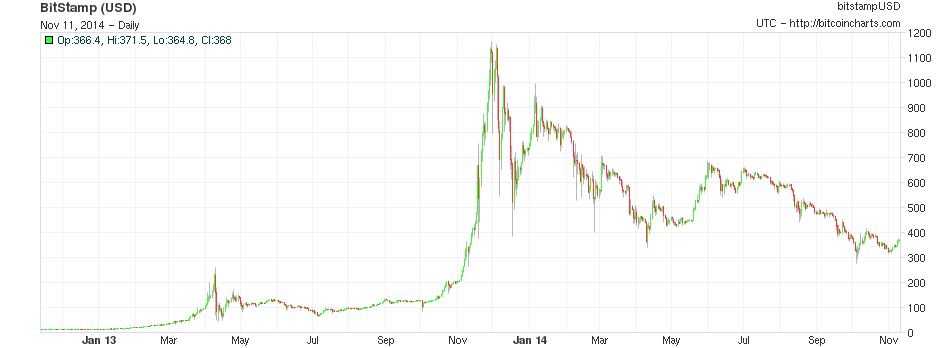

One of many major issues with Bitcoin for bizarre customers is that, whereas the community could also be an effective way of sending funds, with decrease transaction prices, far more expansive international attain, and a really excessive stage of censorship resistance, Bitcoin the foreign money is a really unstable technique of storing worth. Though the foreign money had by and huge grown by leaps and bounds over the previous six years, particularly in monetary markets previous efficiency isn’t any assure (and by environment friendly market speculation not even an indicator) of future outcomes of anticipated worth, and the foreign money additionally has a longtime repute for excessive volatility; over the previous eleven months, Bitcoin holders have misplaced about 67% of their wealth and very often the worth strikes up or down by as a lot as 25% in a single week. Seeing this concern, there’s a rising curiosity in a easy query: can we get one of the best of each worlds? Can we’ve got the total decentralization {that a} cryptographic fee community presents, however on the similar time have the next stage of worth stability, with out such excessive upward and downward swings?

Final week, a crew of Japanese researchers made a proposal for an “improved Bitcoin”, which was an try and just do that: whereas Bitcoin has a hard and fast provide, and a unstable worth, the researchers’ Improved Bitcoin would differ its provide in an try and mitigate the shocks in worth. Nonetheless, the issue of creating a price-stable cryptocurrency, because the researchers realized, is way completely different from that of merely establishing an inflation goal for a central financial institution. The underlying query is tougher: how will we goal a hard and fast worth in a approach that’s each decentralized and sturdy in opposition to assault?

To resolve the problem correctly, it’s best to interrupt it down into two principally separate sub-problems:

- How will we measure a foreign money’s worth in a decentralized approach?

- Given a desired provide adjustment to focus on the worth, to whom will we subject and the way will we soak up foreign money items?

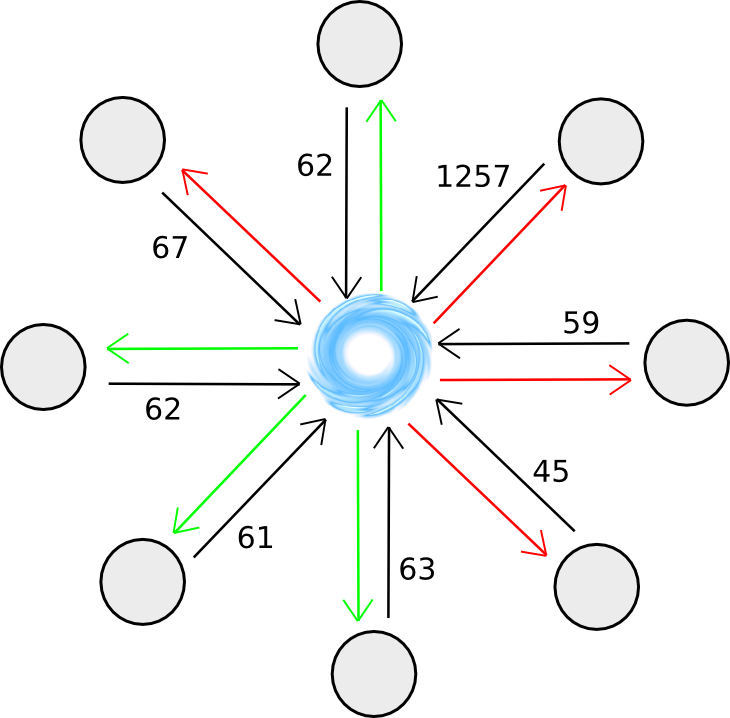

Decentralized Measurement

For the decentralized measurement drawback, there are two identified main courses of options: exogenous options, mechanisms which attempt to measure the worth with respect to some exact index from the surface, and endogenous options, mechanisms which attempt to use inner variables of the community to measure worth. So far as exogenous options go, thus far the one dependable identified class of mechanisms for (presumably) cryptoeconomically securely figuring out the worth of an exogenous variable are the completely different variants of Schellingcoin – primarily, have everybody vote on what the result’s (utilizing some set chosen randomly primarily based on mining energy or stake in some foreign money to forestall sybil assaults), and reward everybody that gives a end result that’s near the bulk consensus. In case you assume that everybody else will present correct data, then it’s in your curiosity to offer correct data with a purpose to be nearer to the consensus – a self-reinforcing mechanism very like cryptocurrency consensus itself.

The primary drawback with Schellingcoin is that it isn’t clear precisely how secure the consensus is. Notably, what if some medium-sized actor pre-announces some various worth to the reality that may be helpful for many actors to undertake, and the actors handle to coordinate on switching over? If there was a big incentive, and if the pool of customers was comparatively centralized, it won’t be too tough to coordinate on switching over.

There are three main components that may affect the extent of this vulnerability:

- Is it doubtless that the contributors in a schellingcoin even have a typical incentive to bias the lead to some route?

- Do the contributors have some frequent stake within the system that may be devalued if the system have been to be dishonest?

- Is it attainable to “credibly commit” to a selected reply (ie. decide to offering the reply in a approach that clearly cannot be modified)?

(1) is reasonably problematic for single-currency techniques, as if the set of contributors is chosen by their stake within the foreign money then they’ve a robust incentive to faux the foreign money worth is decrease in order that the compensation mechanism will push it up, and if the set of contributors is chosen by mining energy then they’ve a robust incentive to faux the foreign money’s worth is just too excessive in order to extend the issuance. Now, if there are two sorts of mining, one in all which is used to pick out Schellingcoin contributors and the opposite to obtain a variable reward, then this objection not applies, and multi-currency techniques may get round the issue. (2) is true if the participant choice is predicated on both stake (ideally, long-term bonded stake) or ASIC mining, however false for CPU mining. Nonetheless, we should always not merely depend on this incentive to outweigh (1).

(3) is maybe the toughest; it is determined by the exact technical implementation of the Schellingcoin. A easy implementation involving merely submitting the values to the blockchain is problematic as a result of merely submitting one’s worth early is a reputable dedication. The unique SchellingCoin used a mechanism of getting everybody submit a hash of the worth within the first spherical, and the precise worth within the second spherical, kind of a cryptographic equal to requiring everybody to place down a card face down first, after which flip it on the similar time; nonetheless, this too permits credible dedication by revealing (even when not submitting) one’s worth early, as the worth may be checked in opposition to the hash.

A 3rd possibility is requiring all the contributors to submit their values instantly, however solely throughout a selected block; if a participant does launch a submission early they’ll at all times “double-spend” it. The 12-second block time would imply that there’s nearly no time for coordination. The creator of the block may be strongly incentivized (and even, if the Schellingcoin is an unbiased blockchain, required) to incorporate all participations, to discourage or stop the block maker from choosing and selecting solutions. A fourth class of choices entails some secret sharing or safe multiparty computation mechanism, utilizing a set of nodes, themselves chosen by stake (maybe even the contributors themselves), as a kind of decentralized substitute for a centralized server answer, with all of the privateness that such an strategy entails.

Lastly, a fifth technique is to do the schellingcoin “blockchain-style”: each interval, some random stakeholder is chosen, and informed to offer their vote as a [id, value] pair, the place worth is the precise legitimate and id is an identifier of the earlier vote that appears right. The motivation to vote accurately is that solely exams that stay in the primary chain after some variety of blocks are rewarded, and future voters will be aware connect their vote to a vote that’s incorrect fearing that in the event that they do voters after them will reject their vote.

Schellingcoin is an untested experiment, and so there’s reliable motive to be skeptical that it’s going to work; nonetheless, if we wish something near an ideal worth measurement scheme it is at the moment the one mechanism that we’ve got. If Schellingcoin proves unworkable, then we must make do with the opposite sorts of methods: the endogenous ones.

Endogenous Options

To measure the worth of a foreign money endogenously, what we primarily want is to search out some service contained in the community that’s identified to have a roughly secure real-value worth, and measure the worth of that service contained in the community as measured within the community’s personal token. Examples of such providers embrace:

- Computation (measured by way of mining issue)

- Transaction charges

- Information storage

- Bandwidth provision

A barely completely different, however associated, technique, is to measure some statistic that correllates not directly with worth, often a metric of the extent of utilization; one instance of that is transaction quantity.

The issue with all of those providers is, nonetheless, that none of them are very sturdy in opposition to fast modifications as a consequence of technological innovation. Moore’s Regulation has thus far assured that almost all types of computational providers grow to be cheaper at a charge of 2x each two years, and it may simply pace as much as 2x each 18 months or 2x each 5 years. Therefore, making an attempt to peg a foreign money to any of these variables will doubtless result in a system which is hyperinflationary, and so we’d like some extra superior methods for utilizing these variables to find out a extra secure metric of the worth.

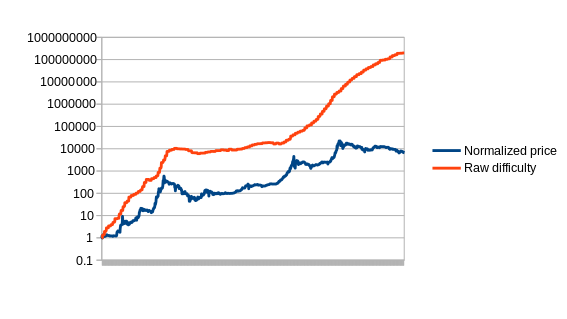

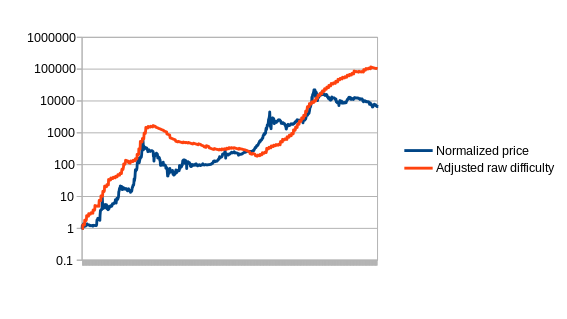

First, allow us to arrange the issue. Formally, we outline an estimator to be a perform which receives an information feed of some enter variable (eg. mining issue, transaction value in foreign money items, and many others) D[1], D[2], D[3]…, and must output a stream of estimates of the foreign money’s worth, P[1], P[2], P[3]… The estimator clearly can not look into the long run; P[i] may be depending on D[1], D[2] … D[i], however not D[i+1]. Now, to start out off, allow us to graph the only attainable estimator on Bitcoin, which we’ll name the naive estimator: issue equals worth.

Sadly, the issue with this strategy is clear from the graph and was already talked about above: issue is a perform of each worth and Moore’s regulation, and so it provides outcomes that depart from any correct measure of the worth exponentially over time. The primary quick technique to repair this drawback is to attempt to compensate for Moore’s regulation, utilizing the issue however artificially lowering the worth by some fixed per day to counteract the anticipated pace of technological progress; we’ll name this the compensated naive estimator. Be aware that there are an infinite variety of variations of this estimator, one for every depreciation charge, and all the different estimators that we present right here will even have parameters.

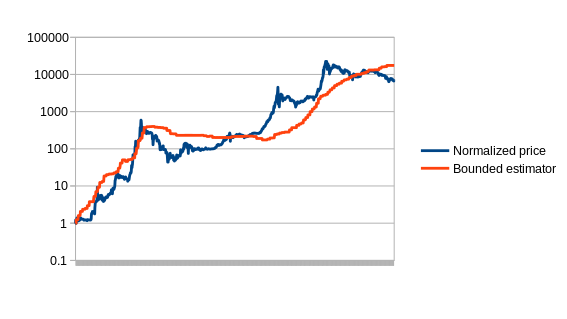

The best way that we are going to choose the parameter for our model is by utilizing a variant of simulated annealing to search out the optimum values, utilizing the primary 780 days of the Bitcoin worth as “coaching information”. The estimators are then left to carry out as they might for the remaining 780 days, to see how they might react to situations that have been unknown when the parameters have been optimized (this method, is aware of as “cross-validation”, is commonplace in machine studying and optimization idea). The optimum worth for the compensated estimator is a drop of 0.48% per day, resulting in this chart:

The subsequent estimator that we are going to discover is the bounded estimator. The best way the bounded estimator works is considerably extra sophisticated. By default, it assumes that each one development in issue is because of Moore’s regulation. Nonetheless, it assumes that Moore’s regulation can not go backwards (ie. know-how getting worse), and that Moore’s regulation can not go quicker than some charge – within the case of our model, 5.88% per two weeks, or roughly quadrupling yearly. Any development exterior these bounds it assumes is coming from worth rises or drops. Thus, for instance, if the issue rises by 20% in a single interval, it assumes that 5.88% of it is because of technological developments, and the remaining 14.12% is because of a worth enhance, and thus a stabilizing foreign money primarily based on this estimator would possibly enhance provide by 14.12% to compensate. The speculation is that cryptocurrency worth development to a big extent occurs in fast bubbles, and thus the bounded estimator ought to be capable to seize the majority of the worth development throughout such occasions.

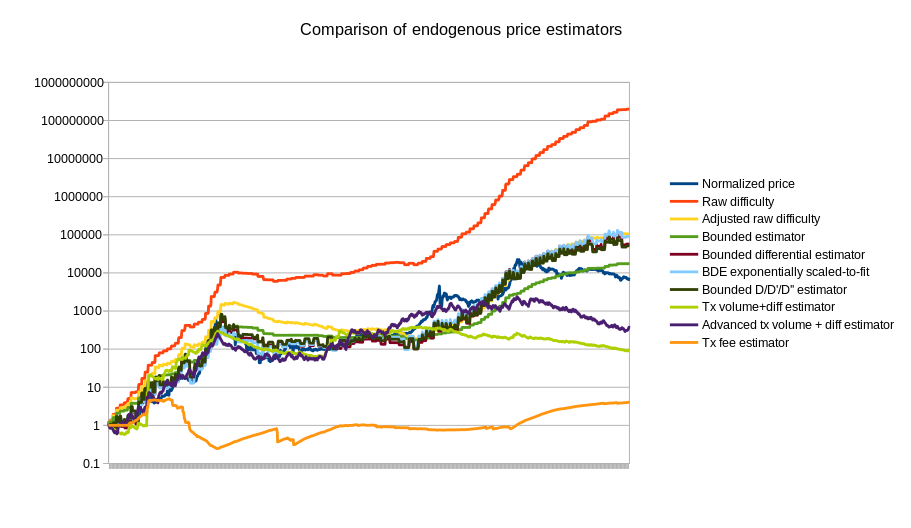

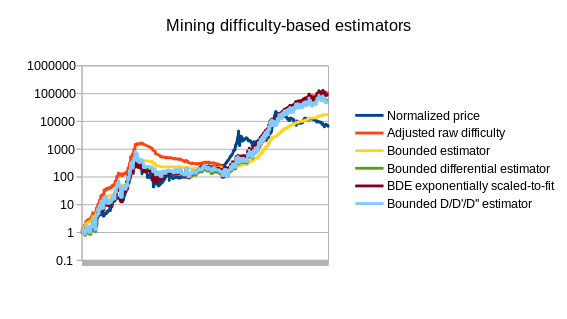

There are extra superior methods as effectively; one of the best methods ought to consider the truth that ASIC farms take time to arrange, and likewise comply with a hysteresis impact: it is usually viable to maintain an ASIC farm on-line if you have already got it even when underneath the identical situations it could not be viable to start out up a brand new one. A easy strategy is wanting on the charge of enhance of the issue, and never simply the issue itself, and even utilizing a linear regression evaluation to venture issue 90 days into the long run. Here’s a chart containing the above estimators, plus a couple of others, in comparison with the precise worth:

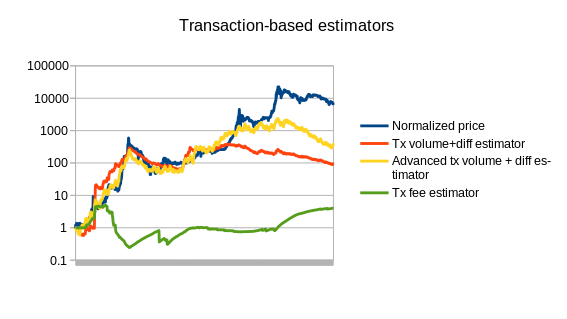

Be aware that the chart additionally consists of three estimators that use statistics aside from Bitcoin mining: a easy and a complicated estimator utilizing transaction quantity, and an estimator utilizing the common transaction price. We will additionally cut up up the mining-based estimators from the opposite estimators:

|

|

See https://github.com/ethereum/economic-modeling/tree/grasp/stability for the supply code that produced these outcomes.

In fact, that is solely the start of endogenous worth estimator idea; a extra thorough evaluation involving dozens of cryptocurrencies will doubtless go a lot additional. The very best estimators could effectively find yourself utilizing a mix of various measures; seeing how the difficulty-based estimators overshot the worth in 2014 and the transaction-based estimators undershot the worth, the 2 mixed may find yourself being considerably extra correct. The issue can also be going to get simpler over time as we see the Bitcoin mining economic system stabilize towards one thing nearer to an equilibrium the place know-how improves solely as quick as the final Moore’s regulation rule of 2x each 2 years.

To see simply how good these estimators can get, we will be aware from the charts that they’ll cancel out at the least 50% of cryptocurrency worth volatility, and should enhance to ~67% as soon as the mining business stabilizes. One thing like Bitcoin, if it turns into mainstream, will doubtless be considerably extra unstable than gold, however not that rather more unstable – the one distinction between BTC and gold is that the availability of gold can truly enhance as the worth goes greater since extra may be mined if miners are keen to pay greater prices, so there’s an implicit dampening impact, however the provide elasticity of gold is surprisingly not that excessive; manufacturing barely elevated in any respect in the course of the run-ups in worth in the course of the Nineteen Seventies and 2000s. The value of gold stayed inside a variety of 4.63x ($412 to $1980) within the final decade; logarithmically lowering that by two thirds provides a variety of 1.54x, not a lot greater than EUR/USD (1.37x), JPY/USD (1.64x) or CAD/USD (1.41x); thus, endogenous stabilization could effectively show fairly viable, and could also be most well-liked as a consequence of its lack of tie to any particular centralized foreign money or authority.

The opposite subject that each one of those estimators should deal with is exploitability: if transaction quantity is used to find out the foreign money’s worth, then an attacker can manipulate the worth very simply by merely sending very many transactions. The typical transaction charges paid in Bitcoin are about $5000 per day; at that worth in a stabilized foreign money the attacker would be capable to halve the worth. Mining issue, nonetheless, is far more tough to use just because the market is so massive. If a platform doesn’t wish to settle for the inefficiencies of wasteful proof of labor, an alternate is to construct in a marketplace for different sources, similar to storage, as an alternative; Filecoin and Permacoin are two efforts that try to make use of a decentralized file storage market as a consensus mechanism, and the identical market may simply be dual-purposed to function an estimator.

The Issuance Drawback

Now, even when we’ve got a fairly good, and even excellent, estimator for the foreign money’s worth, we nonetheless have the second drawback: how will we subject or soak up foreign money items? The best strategy is to easily subject them as a mining reward, as proposed by the Japanese researchers. Nonetheless, this has two issues:

- Such a mechanism can solely subject new foreign money items when the worth is just too excessive; it can not soak up foreign money items when the worth is just too low.

- If we’re utilizing mining issue in an endogenous estimator, then the estimator must consider the truth that among the will increase in mining issue can be a results of an elevated issuance charge triggered by the estimator itself.

If not dealt with very rigorously, the second drawback has the potential to create some reasonably harmful suggestions loops in both route; nonetheless, if we use a distinct market as an estimator and as an issuance mannequin then this won’t be an issue. The primary drawback appears critical; the truth is, one can interpret it as saying that any foreign money utilizing this mannequin will at all times be strictly worse than Bitcoin, as a result of Bitcoin will ultimately have an issuance charge of zero and a foreign money utilizing this mechanism may have an issuance charge at all times above zero. Therefore, the foreign money will at all times be extra inflationary, and thus much less engaging to carry. Nonetheless, this argument is just not fairly true; the reason being that when a person purchases items of the stabilized foreign money then they’ve extra confidence that on the time of buy the items will not be already overvalued and subsequently will quickly decline. Alternatively, one can be aware that extraordinarily massive swings in worth are justified by altering estimations of the likelihood the foreign money will grow to be hundreds of occasions dearer; clipping off this chance will scale back the upward and downward extent of those swings. For customers who care about stability, this danger discount could effectively outweigh the elevated normal long-term provide inflation.

BitAssets

A second strategy is the (authentic implementation of the) “bitassets” technique utilized by Bitshares. This strategy may be described as follows:

- There exist two currencies, “vol-coins” and “stable-coins”.

- Steady-coins are understood to have a price of $1.

- Vol-coins are an precise foreign money; customers can have a zero or optimistic stability of them. Steady-coins exist solely within the type of contracts-for-difference (ie. each detrimental stable-coin is known as a debt to another person, collateralized by at the least 2x the worth in vol-coins, and each optimistic stable-coin is the possession of that debt).

- If the worth of somebody’s stable-coin debt exceeds 90% of the worth of their vol-coin collateral, the debt is cancelled and all the vol-coin collateral is transferred to the counterparty (“margin name”)

- Customers are free to commerce vol-coins and stable-coins with one another.

And that is it. The important thing piece that makes the mechanism (supposedly) work is the idea of a “market peg”: as a result of everybody understands that stable-coins are alleged to be value $1, if the worth of a stable-coin drops under $1, then everybody will notice that it’s going to ultimately return to $1, and so individuals will purchase it, so it truly will return to $1 – a self-fulfilling prophecy argument. And for the same motive, if the worth goes above $1, it can return down. As a result of stable-coins are a zero-total-supply foreign money (ie. every optimistic unit is matched by a corresponding detrimental unit), the mechanism is just not intrinsically unworkable; a worth of $1 might be secure with ten customers or ten billion customers (bear in mind, fridges are customers too!).

Nonetheless, the mechanism has some reasonably critical fragility properties. Certain, if the worth of a stable-coin goes to $0.95, and it is a small drop that may simply be corrected, then the mechanism will come into play, and the worth will rapidly return to $1. Nonetheless, if the worth immediately drops to $0.90, or decrease, then customers could interpret the drop as an indication that the peg is definitely breaking, and can begin scrambling to get out whereas they’ll – thus making the worth fall even additional. On the finish, the stable-coin may simply find yourself being value nothing in any respect. In the true world, markets do usually present optimistic suggestions loops, and it’s fairly doubtless that the one motive the system has not fallen aside already is as a result of everybody is aware of that there exists a big centralized group (BitShares Inc) which is keen to behave as a purchaser of final resort to take care of the “market” peg if vital.

Be aware that BitShares has now moved to a considerably completely different mannequin involving worth feeds supplied by the delegates (contributors within the consensus algorithm) of the system; therefore the fragility dangers are doubtless considerably decrease now.

SchellingDollar

An strategy vaguely just like BitAssets that arguably works significantly better is the SchellingDollar (known as that approach as a result of it was initially supposed to work with the SchellingCoin worth detection mechanism, however it may also be used with endogenous estimators), outlined as follows:

- There exist two currencies, “vol-coins” and “stable-coins”. Vol-coins are initially distributed someway (eg. pre-sale), however initially no stable-coins exist.

- Customers could have solely a zero or optimistic stability of vol-coins. Customers could have a detrimental stability of stable-coins, however can solely purchase or enhance their detrimental stability of stable-coins if they’ve a amount of vol-coins equal in worth to twice their new stable-coin stability (eg. if a stable-coin is $1 and a vol-coin is $5, then if a person has 10 vol-coins ($50) they’ll at most scale back their stable-coin stability to -25)

- If the worth of a person’s detrimental stable-coins exceeds 90% of the worth of the person’s vol-coins, then the person’s stable-coin and vol-coin balances are each decreased to zero (“margin name”). This prevents conditions the place accounts exist with negative-valued balances and the system goes bankrupt as customers run away from their debt.

- Customers can convert their stable-coins into vol-coins or their vol-coins into stable-coins at a charge of $1 value of vol-coin per stable-coin, maybe with a 0.1% trade price. This mechanism is in fact topic to the boundaries described in (2).

- The system retains observe of the full amount of stable-coins in circulation. If the amount exceeds zero, the system imposes a detrimental rate of interest to make optimistic stable-coin holdings much less engaging and detrimental holdings extra engaging. If the amount is lower than zero, the system equally imposes a optimistic rate of interest. Rates of interest may be adjusted by way of one thing like a PID controller, or perhaps a easy “enhance or lower by 0.2% day-after-day primarily based on whether or not the amount is optimistic or detrimental” rule.

Right here, we don’t merely assume that the market will hold the worth at $1; as an alternative, we use a central-bank-style rate of interest concentrating on mechanism to artificially discourage holding stable-coin items if the availability is just too excessive (ie. better than zero), and encourage holding stable-coin items if the availability is just too low (ie. lower than zero). Be aware that there are nonetheless fragility dangers right here. First, if the vol-coin worth falls by greater than 50% in a short time, then many margin name situations can be triggered, drastically shifting the stable-coin provide to the optimistic aspect, and thus forcing a excessive detrimental rate of interest on stable-coins. Second, if the vol-coin market is just too skinny, then it is going to be simply manipulable, permitting attackers to set off margin name cascades.

One other concern is, why would vol-coins be invaluable? Shortage alone won’t present a lot worth, since vol-coins are inferior to stable-coins for transactional functions. We will see the reply by modeling the system as a kind of decentralized company, the place “making income” is equal to absorbing vol-coins and “taking losses” is equal to issuing vol-coins. The system’s revenue and loss situations are as follows:

- Revenue: transaction charges from exchanging stable-coins for vol-coins

- Revenue: the additional 10% in margin name conditions

- Loss: conditions the place the vol-coin worth falls whereas the full stable-coin provide is optimistic, or rises whereas the full stable-coin provide is detrimental (the primary case is extra more likely to occur, as a consequence of margin-call conditions)

- Revenue: conditions the place the vol-coin worth rises whereas the full stable-coin provide is optimistic, or falls whereas it is detrimental

Be aware that the second revenue is in some methods a phantom revenue; when customers maintain vol-coins, they might want to consider the chance that they are going to be on the receiving finish of this further 10% seizure, which cancels out the profit to the system from the revenue present. Nonetheless, one would possibly argue that due to the Dunning-Kruger impact customers would possibly underestimate their susceptibility to consuming the loss, and thus the compensation can be lower than 100%.

Now, take into account a method the place a person tries to carry on to a relentless share of all vol-coins. When x% of vol-coins are absorbed, the person sells off x% of their vol-coins and takes a revenue, and when new vol-coins equal to x% of the present provide are launched, the person will increase their holdings by the identical portion, taking a loss. Thus, the person’s internet revenue is proportional to the full revenue of the system.

Seignorage Shares

A fourth mannequin is “seignorage shares”, courtesy of Robert Sams. Seignorage shares is a reasonably elegant scheme that, in my very own simplified tackle the scheme, works as follows:

- There exist two currencies, “vol-coins” and “stable-coins” (Sams makes use of “shares” and “cash”, respectively)

- Anybody can buy vol-coins for stable-coins or vol-coins for stable-coins from the system at a charge of $1 value of vol-coin per stable-coin, maybe with a 0.1% trade price

Be aware that in Sams’ model, an public sale was used to unload newly-created stable-coins if the worth goes too excessive, and purchase if it goes too low; this mechanism principally has the identical impact, besides utilizing an always-available mounted worth rather than an public sale. Nonetheless, the simplicity comes at the price of a point of fragility. To see why, allow us to make an identical valuation evaluation for vol-coins. The revenue and loss situations are easy:

- Revenue: absorbing vol-coins to subject new stable-coins

- Loss: issuing vol-coins to soak up stable-coins

The identical valuation technique applies as within the different case, so we will see that the worth of the vol-coins is proportional to the anticipated whole future enhance within the provide of stable-coins, adjusted by some discounting issue. Thus, right here lies the issue: if the system is known by all events to be “winding down” (eg. customers are abandoning it for a superior competitor), and thus the full stable-coin provide is predicted to go down and by no means come again up, then the worth of the vol-coins drops under zero, so vol-coins hyperinflate, after which stable-coins hyperinflate. In trade for this fragility danger, nonetheless, vol-coins can obtain a a lot greater valuation, so the scheme is far more engaging to cryptoplatform builders trying to earn income by way of a token sale.

Be aware that each the SchellingDollar and seignorage shares, if they’re on an unbiased community, additionally have to consider transaction charges and consensus prices. Fortuitously, with proof of stake, it must be attainable to make consensus cheaper than transaction charges, during which case the distinction may be added to income. This doubtlessly permits for a bigger market cap for the SchellingDollar’s vol-coin, and permits the market cap of seignorage shares’ vol-coins to stay above zero even within the occasion of a considerable, albeit not whole, everlasting lower in stable-coin quantity. Finally, nonetheless, a point of fragility is inevitable: on the very least, if curiosity in a system drops to near-zero, then the system may be double-spent and estimators and Schellingcoins exploited to dying. Even sidechains, as a scheme for preserving one foreign money throughout a number of networks, are prone to this drawback. The query is solely (1) how will we decrease the dangers, and (2) provided that dangers exist, how will we current the system to customers in order that they don’t grow to be overly depending on one thing that would break?

Conclusions

Are stable-value property vital? Given the excessive stage of curiosity in “blockchain know-how” coupled with disinterest in “Bitcoin the foreign money” that we see amongst so many within the mainstream world, maybe the time is ripe for stable-currency or multi-currency techniques to take over. There would then be a number of separate courses of cryptoassets: secure property for buying and selling, speculative property for funding, and Bitcoin itself could effectively function a novel Schelling level for a common fallback asset, just like the present and historic functioning of gold.

If that have been to occur, and notably if the stronger model of worth stability primarily based on Schellingcoin methods may take off, the cryptocurrency panorama could find yourself in an fascinating state of affairs: there could also be hundreds of cryptocurrencies, of which many could be unstable, however many others could be stable-coins, all adjusting costs practically in lockstep with one another; therefore, the state of affairs may even find yourself being expressed in interfaces as a single super-currency, however the place completely different blockchains randomly give optimistic or detrimental rates of interest, very like Ferdinando Ametrano’s “Hayek Cash”. The true cryptoeconomy of the long run could haven’t even begun to take form.