[ad_1]

Fraud goes to be high of thoughts for all monetary establishments in 2024. Banks and fintechs alike are fixed targets of fraud assaults.

It was attention-grabbing to learn this morning in regards to the expertise of Areas Financial institution in the case of test fraud.

A big regional financial institution based mostly within the South, Areas was beneath hearth from the CFPB for his or her overdraft practices. So, they added a function pioneered by fintechs: entry to pay two days early. Nevertheless it had some unintended penalties.

In late 2022 Areas Financial institution launched Early Pay and up to date its insurance policies so financial institution clients would obtain their pay the identical day Areas receives the cash. The conventional maintain time at banks is 2 days.

This has led to a surge in fraud losses, $135 million between April and September 2023. Their Q3 lack of $53 million was up 40% yr over yr. They’ve now amended their insurance policies placing an extended maintain on giant deposits and fraud losses are anticipated to be $25 million in This fall.

This factors to the dance that each one banks and fintechs should do. How do you present a frictionless expertise in your clients whereas on the identical time mitigating fraud? There isn’t any simple reply as this battle will proceed.

I additionally ought to level out a latest white paper we launched in partnership with Resistant AI on serial fraud. We want a wide selection of anti-fraud instruments to thwart the unhealthy guys today.

Featured

How Areas Financial institution unwittingly invited a surge in test fraud

By Jordan Stutts

The Alabama-based financial institution loosened its funds availability coverage in 2022 as a part of an effort to provide clients early entry to their paychecks. “We opened the door too extensive, unhealthy individuals got here speeding in, and we didn’t shut the door well timed sufficient,” Areas’ CFO mentioned.

From Fintech Nexus

> Will Embedded Finance Make Software program Corporations the New Group Banks?

By Luke Voiles

With neighborhood banks pulling again on lending to small companies vertical software program platforms are filling the void. They supply software program, after all, however are more and more additionally offering entry to capital.

> Whitepaper Discusses the Risk Posed by Serial Fraud

By Fintech Nexus Employees

Serial fraud is changing into a serious downside for monetary establishments at present as criminals use automation and scale like by no means earlier than. This white paper offers actionable steps to fight serial fraud.

Podcasts

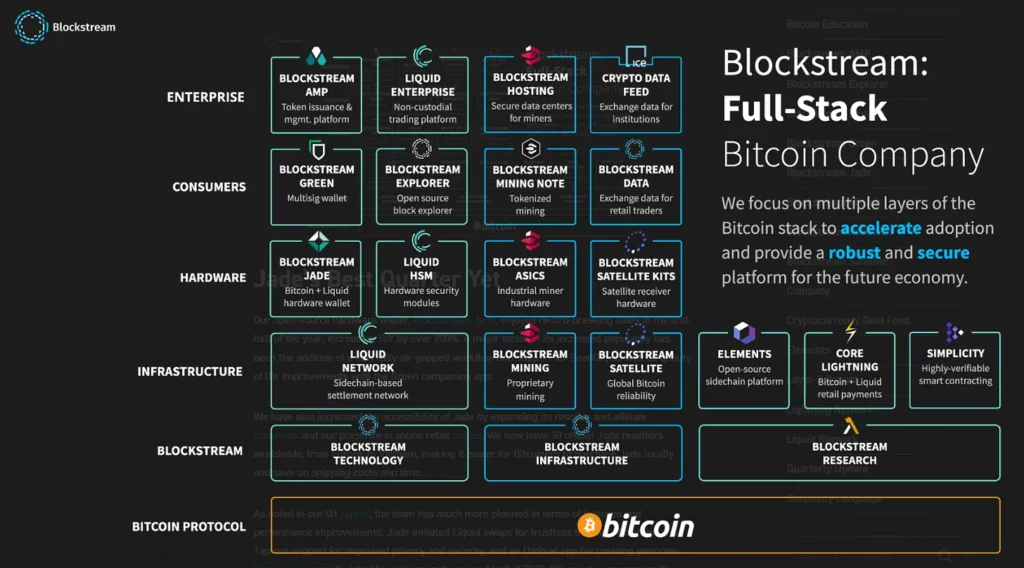

Podcast: Advancing Bitcoin with Lightning, Inscriptions, and L2s, with Blockstream’s Chief Product Officer Jeff Boortz

Hello Fintech Architects, Welcome again to our podcast collection! For those who need to subscribe in your app of alternative, you may…

Webinar

Fraud Dangers to be careful for in 2024

Jan 18, 12pm EST

In our extremely digital world, companies work with clients from all around the globe and at increased volumes, the place selections…

Additionally Making Information

- International: Former Anthemis accomplice soft-launches new fintech-focused enterprise agency

Ruth Foxe Blader has left her position as accomplice at Anthemis Group after practically seven years to begin her personal enterprise agency, Foxe Capital, TechCrunch realized solely at present. Blader is joined by former Anthemis funding affiliate Kyle Perez. Sophie Winwood is serving as an working accomplice.

- USA: An Inside Take a look at Ally Financial institution’s Measured Roll-Out of GenAI

Q&A: As monetary establishments race to implement AI throughout their organizations, public nervousness and authorities scrutiny are intensifying. Can banks deploy and leverage AI to energy progress whereas avoiding public backlash? Ally Financial institution’s strategy – concurrently trailblazing and prudent – is one promising mannequin.

To sponsor our newsletters and attain 220,000 fintech fans along with your message, contact us right here.

[ad_2]