[ad_1]

Defunct crypto lending platform Celsius is in line to unstake and presumably promote practically half a billion {dollars} value of Ethereum (ETH), in line with on-chain knowledge.

Celsius, now going by way of a prolonged chapter course of, was a service that used to supply prospects yield on their crypto deposits.

Nonetheless, the agency collapsed after it allegedly mishandled buyer property, and its founder Alex Mashinsky was finally arrested and charged with fraud.

Now, Celsius is liquidating what’s left of its property in an effort to compensate its prospects.

Making an announcement through the social media platform X, Celsius says it has begun the unstaking course of for its Ethereum holdings, which it has been utilizing to generate earnings for its property during the last yr and a half.

“In preparation of any asset distributions, Celsius has began the method of recalling and rebalancing property to make sure ample liquidity

Celsius will unstake current ETH holdings, which have offered precious staking rewards earnings to the property, to offset sure prices incurred all through the restructuring course of.

The numerous unstaking exercise within the subsequent few days will unlock ETH to make sure well timed distributions to collectors.

As a reminder, eligible collectors will obtain in-kind distributions of BTC and ETH as outlined within the accepted Plan.”

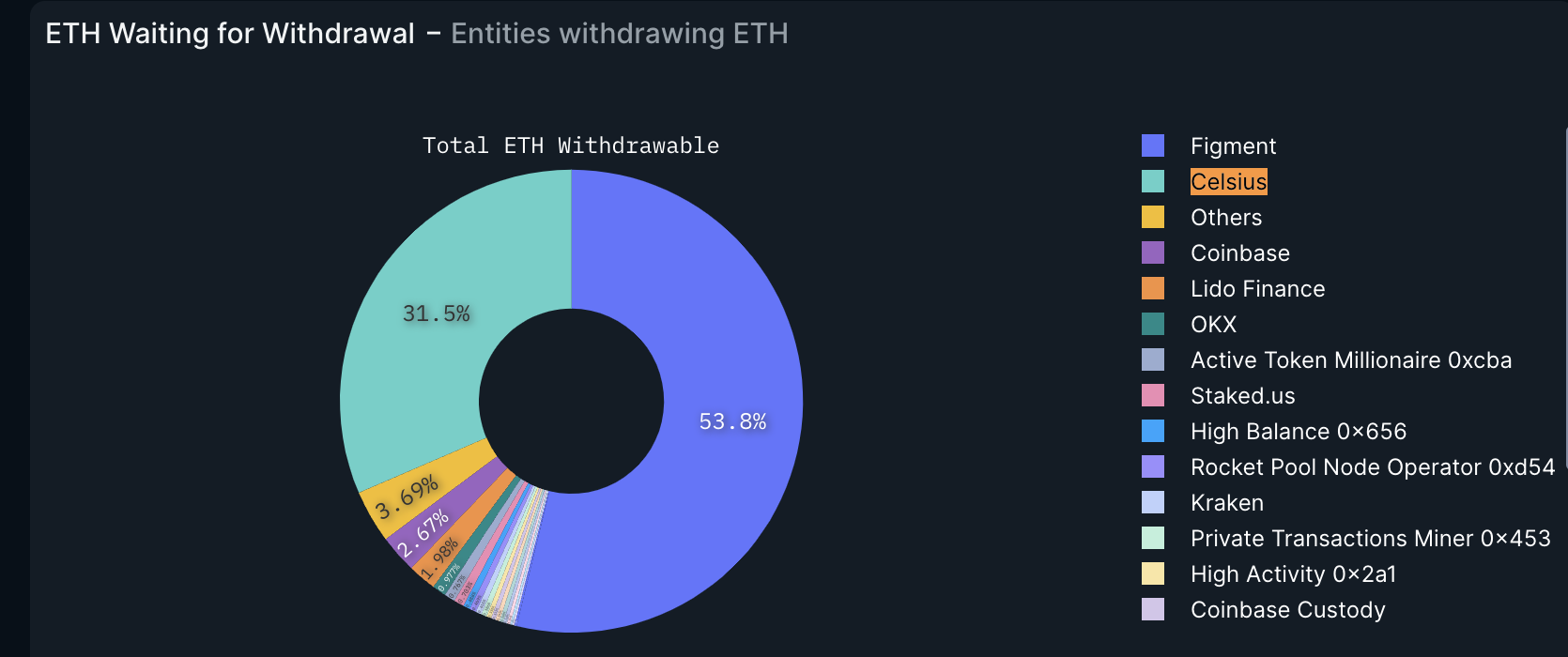

In accordance with blockchain analytics platform Nansen, Celsius is presently ready to unstake a complete of 206,319 ETH value practically $470 million.

Late final yr, a decide accepted a brand new plan from Celsius that goals to generate funds for a brand new mining and staking company spinoff designed to repay collectors.

The corporate, dubbed “NewCo,” could have a $1.25 billion stability sheet, $450 million of which can be liquid crypto.

As said within the court docket paperwork signed by Chapter Choose Martin Glenn,

“NewCo intends to stake some or all of this liquid cryptocurrency to earn staking yields on the Ethereum community, which might generate anyplace from $10 to $20 million per yr.”

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Examine Worth Motion

Comply with us on Twitter, Fb and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl are usually not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual threat, and any loses it’s possible you’ll incur are your accountability. The Each day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Each day Hodl an funding advisor. Please notice that The Each day Hodl participates in online marketing.

Featured Picture: Shutterstock/eliahinsomnia

[ad_2]