The Bitcoin market is at present on edge as distinguished analyst Crypto Rover warns of a possible liquidation occasion that would negatively have an effect on the brief holders.

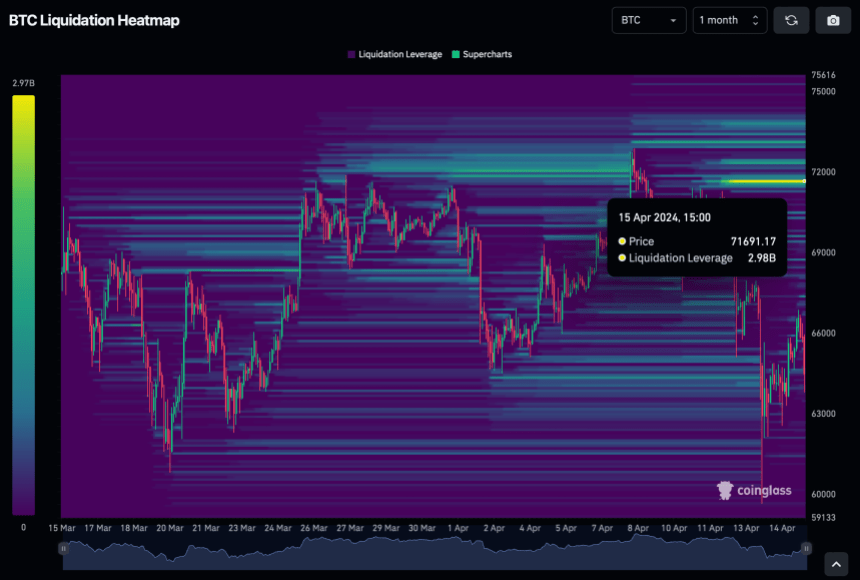

With Bitcoin buying and selling inside a major consolidation part, as revealed by Rover, evaluation means that over $3 billion briefly positions may face liquidation ought to Bitcoin climb again to a selected value mark.

Bitcoin Bears Beware Of This Worth Vary

In response to Rover, the essential value mark, which is the $71,600 area, is the place the $3 billion brief liquidation would happen if Bitcoin reclaims it. Rover’s evaluation is predicated on knowledge gathered from CoinGlass, a famend spinoff market tracker, indicating a considerable liquidity accumulation at greater value ranges.

The latest warning from Crypto Rover comes amidst a interval of turbulence within the crypto market, marked by sharp value actions and heightened buying and selling exercise.

Significantly, Bitcoin skilled a sudden decline over the weekend, bringing its value to as little as $62,000 within the zone. Nevertheless, within the early hours of Monday, the asset confirmed indicators of restoration, briefly reaching a excessive of $66,797 earlier than retracing to its present value of $64,711.

The market downturn over the weekend witnessed a document variety of liquidations, with over $1.2 billion in Bitcoin lengthy positions liquidated in a single day, based on WhaleWire.

JUST IN: Over $1.2 Billion in #Bitcoin longs have been liquidated over the past 24 hours, amid market decline, setting a brand new document. The earlier document was $879M.

At the moment, extra Bitcoin bulls have been liquidated than on any day within the final 15 years.

One more reason why shopping for up… pic.twitter.com/itnwb7rj1d

— WhaleWire (@WhaleWire) April 13, 2024

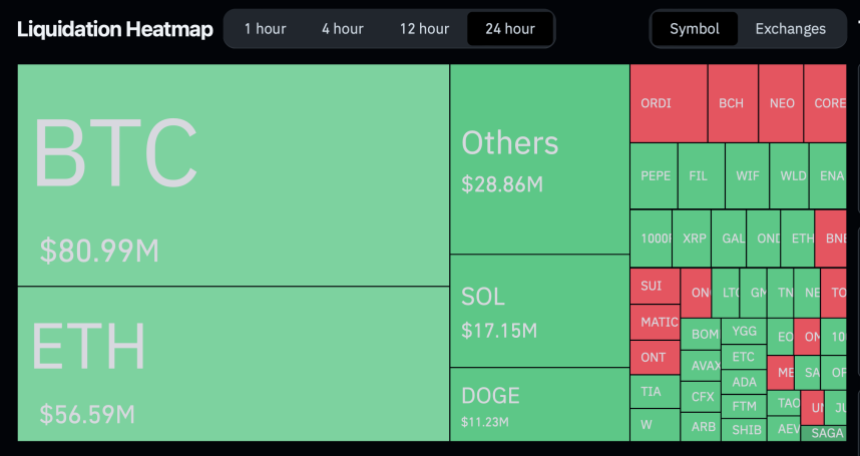

The liquidation hasn’t stopped, as the most recent knowledge from Coinglass reveals that previously 24 hours alone, 89,151 merchants have been liquidated, leading to a complete lack of $266.10 million.

Analyst Insights And Market Dynamics

It’s price noting that Bitcoin’s recorded slight restoration comes as Hong Kong regulators granted provisional approval for asset managers to launch spot Bitcoin and Ethereum exchange-traded funds (ETFs).

Crypto analyst Willy Woo has shared his perspective on the potential influence of Bitcoin exchange-traded funds (ETFs) on market dynamics.

In response to Woo, introducing the brand new Bitcoin ETFs may result in important value targets, with projections starting from $91,000 on the bear market backside to $650,000 on the bull market prime.

The brand new #Bitcoin ETFs brings value targets of $91k on the bear market backside and $650k on the bull market prime as soon as ETF buyers have totally deployed based on asset supervisor suggestions***.

These are very conservative numbers. #Bitcoin will beat gold cap when ETFs have…

— Willy Woo (@woonomic) April 15, 2024

Woo’s evaluation underscores the rising institutional curiosity in BTC, with asset managers anticipated to allocate a considerable portion of their funds to the cryptocurrency.

Nevertheless, Woo emphasizes that these projections are conservative estimates, and Bitcoin’s market capitalization may exceed gold as extra capital is deployed into the asset.

Featured picture from Unsplash, Chart from TradingView

Disclaimer: The article is supplied for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding selections. Use data supplied on this web site completely at your individual threat.